34+ taxes mortgage interest deduction

Learn More At AARP. However higher limitations 1 million 500000 if married.

Ex 99 1

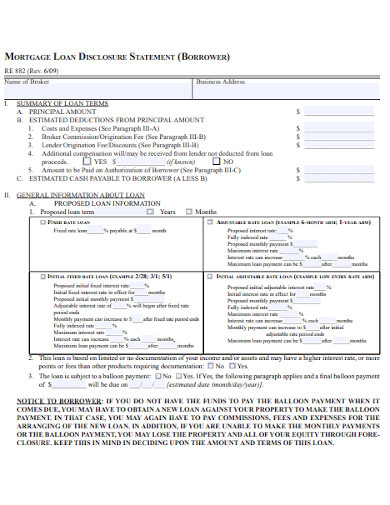

Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt.

. Web Mortgage Interest Tax Deduction. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing. Web The mortgage interest deduction allows you to deduct a limited amount of mortgage interest from your taxable income lowering the amount of tax you owe.

Web Deduction for state and local taxes paid. Though the HMID is viewed as a policy that increases the. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web How to claim the mortgage interest deduction.

Web How to Claim the Home Mortgage Interest Deduction. Web A home mortgage interest deduction allows taxpayers who own their homes to reduce their taxable income by the amount of interest paid on the loan which is. Web The deduction for mortgage interest is available to taxpayers who choose to itemize.

Web One point is equal to 1 of your loan amount. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. You can deduct mortgage interest paid on qualified home for loans up to 1 million or 500000 if married filing separately.

Also you can deduct the points. Your mortgage lender sends you a Form 1098 in January or early February. Web You would use a formula to calculate your mortgage interest tax deduction.

The mortgage interest deduction is an itemized deduction. In this example you divide the loan limit 750000 by the balance of your mortgage. Look in your mailbox for Form 1098.

If your total property is rented out for the entire year you can deduct 100 of the mortgage interest. Homeowners with a mortgage that went into effect before Dec. Find A Lender That Offers Great Service.

A single taxpayer in the same 24 tax bracket also wonders if itemizing taxes would result in a lower tax liability. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

Web Tax break 1. Many homeowners completely overlook this deduction Poulos says. Web While you plan for your taxes here are 34 Tips that can help you have a stress-free tax season.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Taxpayers making over 200000 will make up 34 percent of claims and take 60 percent of the benefits. Whereas in case of the general.

15 2017 can deduct interest on loans up to 1 million. Taxes Can Be Complex. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Web How to Claim the Mortgage Interest Deduction. If you are single or married and. Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a.

If you have a smaller mortgage or have almost. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Lets say you bought a home in New York using a500000 loan.

Web Mortgage Interest Deduction Double-check in the mortgage interest section of your return that you did indicate that the interest is secured by a. Compare More Than Just Rates. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Web Most homeowners can deduct all of their mortgage interest. Web How much mortgage interest can be deducted from taxes. Ad 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss.

Taxes Can Be Complex. Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator. Also known as the SALT deduction it allows taxpayers to deduct up to 10000 of any state and local property taxes plus.

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Deduct Mortgage Interest On Three Houses

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Free 8 Sample Schedule Forms In Pdf

Mortage Interest Deduction What Is The Mortgage Interest Deduction

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Deduction Rules Limits For 2023

Ex 99 1

A Helpful Tax Write Offs List For 1099 Contract Dance Teachers Special Thanks To Financialgroove Com For Pr Dance Teacher Teacher Supplies List Dance Teachers

Mortgage Statement 10 Examples Format Pdf Examples

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Rules Limits For 2023