29+ Maximum i can borrow mortgage

Larger loans also known as jumbo. This drastically affects how much they can borrow for a mortgage.

Cape May Mortgage Company Home Facebook

However even with that 85 cap the actual amount that you as an individual can borrow.

. Well once you know how much you can borrow plus your deposit this is the key to unlocking your property search and identifying the range of properties that you can afford. Ad Get a Mortgage for Your UK Home or Buy to Let Property. Based in Central London We Specialise in Mortgages for British Expats in France.

Interest rate The bigger your deposit the better the. Get the Right Housing Loan for Your Needs. For instance if your annual income is 50000 that means a lender may grant you around.

You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price. The easiest option is to use income multiples. Ad Get a Mortgage for Your UK Home or Buy to Let Property.

In some cases we could find lenders willing to go. In the current conservative lending climate most lenders will offer a maximum of four times a single applicants base income or about three. A typical mortgage length is 25 years.

How much mortgage can you. Ad Compare the Best Mortgage Rates From Top Ranked. Generally lend between 3 to 45 times an individuals annual income.

So to buy the average UK house costing 250000 youd normally need at least a 25000. At least one buyer is a Singapore citizen Have not taken two or more HDB loans Gross monthly. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income.

The maximum amount you can borrow with an FHA-insured HECM in 2022 is. The first step in buying a house is determining your budget. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability criteria.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. There are several factors to consider when youre looking at how much you can borrow on a mortgage. Mortgage lenders in the UK.

Income Financial standing Other eligibility requirements are. The longer your term the less you may pay each month but youll end up paying more in interest. Typically you need at least 10 of the homes value as a deposit to get a mortgage.

Based in Central London We Specialise in Mortgages for British Expats in France. This maximum mortgage calculator collects these important variables and determines the maximum monthly housing payment and the resulting mortgage amount. Since the financial crisis of 2008 regulators have introduced tougher and tighter.

Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross income. The borrowers age. Under this particular formula a person that is earning.

You can usually borrow as much as 80 or 85 of your. You can usually only borrow up to 85 of the equity you have in your home. Or 4 times your joint income if youre applying for a mortgage.

What Is A Mortgage The basic loan limit for 2021 is 548250 up from 510400 in 2020. You can calculate your mortgage qualification based on income purchase.

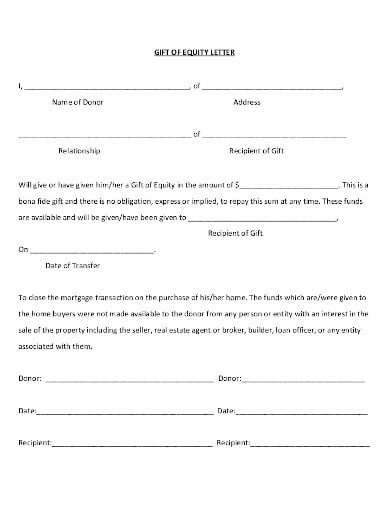

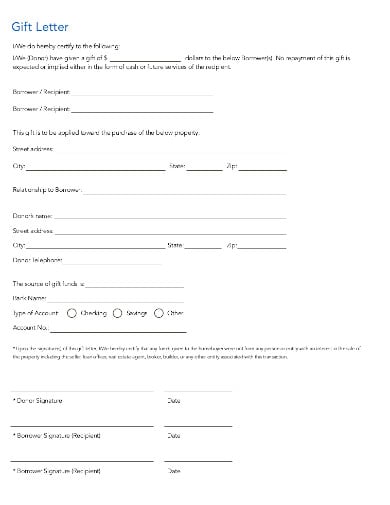

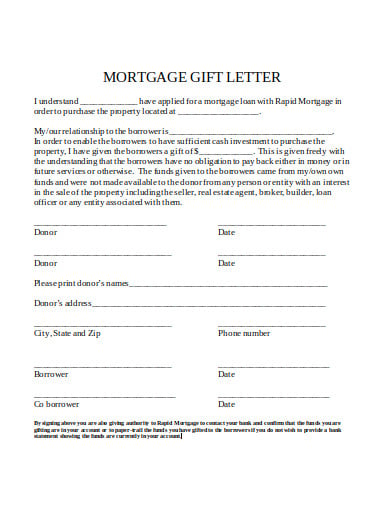

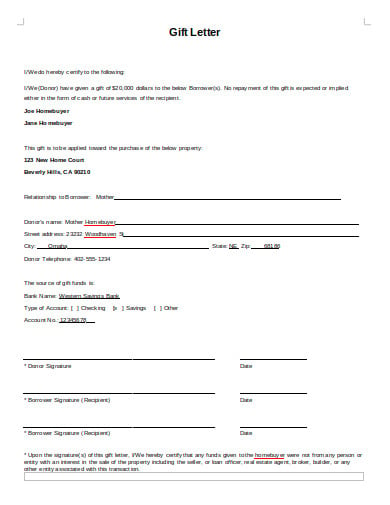

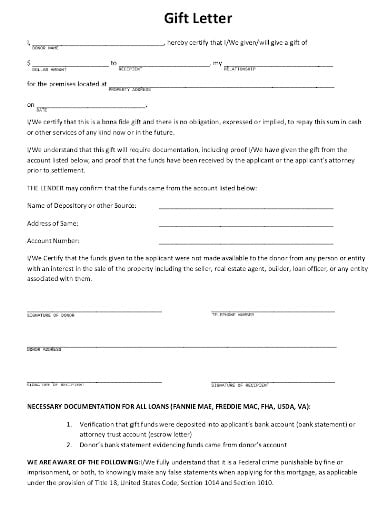

10 Mortgage Gift Letter Templates In Pdf Word Free Premium Templates

20 Distinctive Kitchen Lighting Ideas For Your Wonderful Kitchen Decoracion De Cocina Moderna Accesorios De Iluminacion De La Cocina Iluminacion Para Isla De Cocina

7lz07qmzpggsom

10 Mortgage Gift Letter Templates In Pdf Word Free Premium Templates

How Fannie Mae And Freddie Mac Work Fannie Mae Borrow Money Understanding

Heloc Infographic Heloc Commerce Bank Mortgage Advice

10 Mortgage Gift Letter Templates In Pdf Word Free Premium Templates

10 Mortgage Gift Letter Templates In Pdf Word Free Premium Templates

Cape May Mortgage Company Home Facebook

2

Cape May Mortgage Company Home Facebook

036 Vivo Wallet App Redesign Vivo App Money Financial

10 Mortgage Gift Letter Templates In Pdf Word Free Premium Templates

Sba Eidl Loan Increase Eidl Loan Increase Request And Re Consideration

Ljyws6vcjuwfzm

Wondering If You Should Buy A Home Today Experts Say Home Prices Will Continue To Appreciate In The Comin In 2022 Mortgage Loan Originator House Prices Home Ownership

Know The Cost Of Waiting Or In Some Cases The Cost Of Procrastinating Interoolympics Visit Buyo Real Estate Advice Real Estate Infographic Selling Real Estate